This article is an excerpt from the InvestorPlace Digest newsletter. To get news like this delivered straight to your inbox, click here.

The timpani, surprisingly, is one of the most challenging orchestral instruments to play. Though these kettle drums seem as straightforward as hitting a piñata, the 140-pound vessels are actually the heart of most orchestral pieces.

With their perfect sense of timing, top percussionists can guide an entire orchestra, even without a conductor on stage. Their rhythm drives the entire ensemble forward.

But get the timing wrong, and even the New York Philharmonic can sound like an amateur band. There’s a reason why the highest-paid non-principal musician in the Boston Symphony Orchestra, in 2018 at least, was a timpanist.

The same is true for investing in blue-chip stocks. These dependable companies seem almost magical to portfolios; $1,000 invested in Home Depot (NYSE:HD) in 1990 would be worth almost $2 million today. But buying at the wrong moment can be a minor disaster. A company like Home Depot might only return 5% or 15% per year, so market corrections can take years to recover from. Home Depot itself took over 10 years to dig out of a 60% share decline in 2000.

Just like playing the drums, timing is everything when it comes to buying blue-chip stocks.

Nowhere is this clearer than in stocks today. This year, the Dow Jones Industrial Average, an index of conservative U.S. companies, has risen just 4.2%, underperforming the Nasdaq Composite index’s 30.2% return by an enormous margin.

Even worse, many of the Dow Jones’ constituents have seen shares fall, just as the U.S. economy surges ahead. Investors see high-growth stocks like Nvidia (NASDAQ:NVDA) returning 200% in less than a year and are selling off their more conservative holdings to get a piece. Shares of blue-chip Nike (NYSE:NKE) are down 20% this year, and those of Walgreens Boots Alliance (NASDAQ:WBA) have collapsed 40%.

So, how can investors know when to jump back into blue-chip stocks?

Introducing TradeSmith’s Intelligent Algorithms

That’s where quantitative tools like those at our partner, TradeSmith, come in. Many stocks follow identifiable patterns, and artificial intelligence (AI)-based tools are excellent at sniffing these out.

For instance, we know that certain sectors respond differently to market cycles. Utility stocks do better during contractions, while financials outperform during expansions. Meanwhile, consumer durable stocks often ignore cycles entirely. Walmart (NYSE:WMT) stock actually rose in 2008 as cash-strapped consumers traded down.

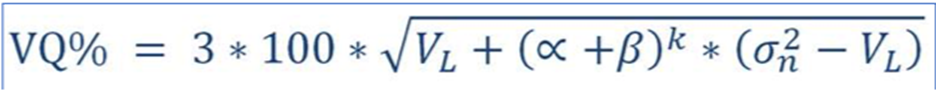

All these insights are neatly encapsulated in a formula by TradeSmith’s system.

As TradeSmith CEO Keith Kaplan explains, this “magic formula” is a measure of historical and recent volatility – or risk – in a stock, fund, or crypto. And that measurement can help investors predict not only which stocks will rise… but also when it can happen.

Later this week, Eric Fry will sit down with Keith for the 11X Stock Market Accelerator Summit to help readers better understand how the system works, and why these “intelligent algorithms” outperform the market by such a wide margin. You can save your spot for that event – on Wednesday, September 27, at 8 p.m. Eastern – by going here.

And to get you started, here are three blue-chip stocks that TradeSmith’s system now recommends you buy before they resurge.

High-Quality Stocks to Buy the Dip: Honeywell (HON)

Shares of industrial giant Honeywell International (NASDAQ:HON) fell double digits this summer after the firm announced Q2 earnings that only met Wall Street expectations. Investors were expecting a massive earnings beat, and Honeywell’s 2-cent outperformance wasn’t good enough. Ordinarily, such a drawdown could take years for Honeywell to recover from, given the stock’s historically slow growth.

A recent uptick in Honeywell’s share price, however, has now landed the Indiana-based firm on TradeSmith’s radar. According to the quantitative system, Honeywell’s shares could surge to $225 by next July, a 15% return. That would give the blue-chip industrial one of the highest upsides of any conservative stock.

InvestorPlace.com writer Omor Ibne Ehsan agrees. In a recent briefing, he writes how Honeywell’s balance sheet is “rock-solid” and that shares are undervalued.

Despite near-term macro concerns, Honeywell’s leadership sees strength ahead. Commercial flight activity continues to recover, fueling aerospace demand. Energy, non-residential construction, and pent-up infrastructure investment provide additional tailwinds. At 20-times earnings, HON stock offers reasonable value. The company’s defensive attributes combined with its upside potential check all the blue-chip boxes.

These predictions are also supported by fundamental analysis. According to a three-stage discounted cash flow (DCF) model, Honeywell’s shares are likely worth $220 to $230 thanks to its consistent cash flows and diversification across multiple industrial sectors. The company also has a strong history of deploying capital. Now that TradeSmith’s system has identified an ideal entry point, conservative investors should take note.

2. Leidos Holdings (LDOS)

Leidos Holdings (NYSE:LDOS) is one of the most undervalued blue-chip stocks on my radar today. The defense company trades at under 14X forward price-to-earnings, despite consistently achieving 20% return on equity (ROE). My valuation systems show that shares could be worth as much as 60% higher by 2026. The only reason I’ve stayed away is because Leidos has a history as a “value trap,” a case where shares remain constantly underpriced.

TradeSmith’s formulas now see this “trap” disappearing. The quantitative system now believes that shares could rise to $110 in the coming fourth quarter, 18% upside from current levels. That’s an enormous upside for a stock that currently sits in the bottom 2% of companies based on implied volatility. (In other words, 98% of companies have more volatile stock prices.) An 18% price jump would also bring Leidos more in line with competitors from a relative valuation standpoint.

Ian Cooper also finds Leidos a compelling buy. In an update this week, the InvestorPlace.com writer notes how strong earnings and guidance from Leidos’ management should push shares higher:

In its most recent quarter, the company posted Q2 2023 EPS of $1.80, which beat expectations by 23 cents. Revenue of $3.8 billion, up 7.7% YOY, beat expectations by $70 million. Net bookings totaled $2.9 billion in the quarter, representing a book-to-bill ratio of 0.8… In addition, the company raised revenue guidance from a range of $14.9 billion to $15.2 billion from $14.7 billion to $15.1 billion.

Essentially, Leidos continues to march ahead with growth and profitability, regardless of the discount that its shares typically trade at. Analysts expect a constant 5% increase in annual revenues, which will translate into 10% improvements in earnings per share through 2026. Bolt-on acquisitions, like Leidos’ 2022 purchase of Australian-based Cobham Special Mission, also add to upside potential.

Though Leidos has long traded like a value trap, TradeSmith’s system now believes that a turnaround will soon get underway for this blue-chip stock.

3. Goldman Sachs (GS)

2022 was an understandably awful year for Goldman Sachs Group (NYSE:GS). The IPO market fizzled, profits slumped, and the company was forced into multiple rounds of layoffs. We haven’t seen this many Goldman Sachs cuts since the 2008 financial crisis.

Fundamental-based investors have been slow to jump back in. Bank valuations are dependent on the health of the economies they service, and the U.S. economy has been on shaky ground for much of this year.

TradeSmith’s quantitative system now suggests that it’s time to revisit Wall Street’s golden child. According to the system’s estimates, shares of Goldman Sachs could rise to $400 by Q2 next year. That’s a 20% upside from current levels.

A recent improvement in the IPO market could be a factor, as InvestorPlace.com Larry Ramer notes in an article this week:

CEO David Solomon said in a Sept. 12 interview that the performance of capital markets is rebounding. That’s certainly very positive news for Goldman, which makes most of its money from handling deals in those markets.

These deals include the blockbuster listings from Arm Holdings (NASDAQ:ARM) and Instacart (NASDAQ:CART) – a company that turned its founder into an overnight billionaire.

Stabilizing interest rates are another tailwind. Companies tend to be more willing to go public during stable financial environments, and a pause in rate hikes in 2024 will give Goldman the environment it needs to succeed.

Finally, Goldman’s self-enforced reorganization will help slim down the firm just in time for a market recovery. The company’s efficiency ratio, a measure of costs, ballooned from 53.8% to 65.8% in 2022, far higher than its 60% target rate. (As a reminder, high efficiency ratios are worse for banks.) Analysts now believe that efficiency ratios can improve to 63.6% next year, which will send net income up 35% to $12.3 billion.

When Timing Is Everything

When I started my investment career, many investors had given up on the idea of market timing. The “random walk” theory was all the rage, and indexing was the “smart” way to invest. Even Warren Buffett’s halo was beginning to fade.

If you can’t beat the market, why not settle for average?

But the 2008 financial crisis changed all that. Suddenly, the importance of market timing came roaring back. Those who had avoided the rich valuations leading up to the financial crisis were rewarded with incredible deals by the time March 2009 rolled around. Even Buffett would use the period to scoop up discounted shares of Bank of America (NYSE:BAC), Goldman Sachs, and other cheaply priced blue-chip stocks.

The trick, of course, is knowing that emotions matter in the stock market. A 20% share decline doesn’t happen in a vacuum. And no amount of fundamental analysis can tell you if a blue-chip stock will rise or fall over the next month.

That’s where AI comes in. These systems are perfect for sniffing out patterns, just like the ones seen in the 2008 drawdowns. AI doesn’t carry the same emotional biases that we do, and they don’t get tired after sifting through millions of data points.

And so, on Wednesday, September 27, at 8 p.m. Eastern, InvestorPlace’s Eric is sitting down with Keith to unveil powerful AI-based technology that gives ordinary investors a real opportunity to make 11X more than they usually would on every stock, ETF, or fund they own. Sign up to reserve your spot here.

After checking out Eric and Keith’s 11X Stock Market Accelerator Summit on Wednesday, I look forward to seeing you back here next Sunday.

As of this writing, Tom Yeung did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.