Electric vehicle stocks had a rough ride in 2022, all thanks to shortages of essential supplies, sky-high inflation, rising interest rates and issues over the pandemic. However, don’t count them out just yet. Global leaders are demanding millions of EVs on the roads in an effort to reduce emissions. The U.S. wants to reduce emissions by 52%. Europe is targeting 55%. China even says it will stop releasing carbon dioxide in the next 40 years.

The International Energy Agency says we could see up to 135 million electric vehicles on the roads in the next decade. Analysts at Ernst & Young say EVs could outpace combustion engines globally over the same period. Bloomberg NEF says that, by 2030, more than half of passenger cars sold in the United States will be electric, driven in part by incentives put in place by the Inflation Reduction Act.

That being said, I’d start buying beaten-down electric vehicle stocks, and related stocks, for longer-term growth.

| ALB | Albemarle | $213.97 |

| KARS | KraneShares Electric Vehicles and Future Mobility | $27.56 |

| FCX | Freeport McMoRan | $37.74 |

| CHPT | ChargePoint | $8.30 |

| FDRV | Fidelity EVs and Future Transportation ETF | $14.77 |

Albemarle (ALB)

Albemarle (NYSE:ALB) is one of the top electric vehicle stocks to own heading into 2023. Not only is it ridiculously oversold, but it’s also one of the top ways to trade the lithium story.

As the world continues to deal with a tight supply-demand issue with lithium, ALB is well-positioned to capitalize. For one, the company drew about 60% of its sales from lithium in the third quarter. Two, company revenues are surging along with lithium prices, which soared about 100% year-over-year.

We also have to remember the lithium story isn’t cooling off — at least not anytime soon. For an idea of just how tight the lithium situation is, Forbes.com contributor Tristan Bove says, “At current extraction rates, carmakers will need more mining to hit industry forecasts of as many as 300 million electric vehicles on the road worldwide by 2030, as will countries to meet their commitments to achieve net-zero carbon emissions.”

Krane Shares Electric Vehicles and Future Mobility (KARS)

It’s never a good idea to put all your eggs in one basket. Instead, you want to diversity for safety, with an exchange-traded fund such as the Krane Shares Electric Vehicles and Future Mobility (NYSEARCA:KARS). With this fund, all your eggs are in different baskets: electric vehicles, autonomous driving, lithium and copper production, hydrogen fuel and semiconductors. In fact, you’re safer diversifying with an ETF like KARS, than putting all your money in a single stock like Tesla (NASDAQ:TSLA).

With an expense ratio of 0.70%, some of the KARS ETF top holdings include Samsung (OTCMKTS:SSNLF), Panasonic Holdings (OTCMKTS:PCRFY), Aptiv (NYSE:APTV), Li Auto (NASDAQ:LI), BYD Co. (OTCMKTS:BYDDY) and dozens more. Also, while the KARS ETF is down about 46% from its 2021 highs, give it time. As the EV story improves, I’d like to see the ETF again challenge its former high of $54.43.

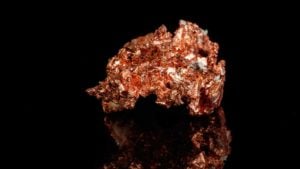

Freeport McMoRan (FCX)

Another key component of the electric vehicle story is copper. That’s because EVs use about two and a half times more copper than your combustion engine cars, which could help pull Freeport McMoRan (NYSE:FCX) well off recent lows.

In fact, “Between today and 2035, achieving the net-zero emissions by 2050 goals will translate into a rapid ramp-up of copper demand, increasing by more than 82 percent between 2021 and 2035,” according to S&P Global analysts, as quoted by InvestingNews.com. “This ramp-up is largely driven by the required transition to clean vehicles and electrification of the economy.”

Helping, ConocoPhillips (NYSE:COP) CEO and FCX Director, Ryan Lance, just bought $988,300 worth of FCX stock at an average price of $31.88 each. Better, FCX just declared a cash dividend of $0.15 per share on FCX’s common stock, payable on Feb. 1, 2023, to shareholders of record as of Jan. 13, 2023. From a current price of $37.74, I’d like to see the FCX stock rally back to $50, especially as copper prices recover.

ChargePoint (CHPT)

With the electric vehicle boom set to accelerate, we’ll need a good deal of charging stations, which is great news for companies like ChargePoint (NYSE:CHPT). After all, we can’t have millions of EVs on the roads, and not have anywhere to charge them.

“With the total cumulative investment in EV charging infrastructure in the United States and Europe expected to be $60 billion by 2030 and $192 billion by 2040, ChargePoint’s established business model, comprehensive portfolio for nearly every charging scenario today, recurring revenue and growing customer base demonstrate it is well positioned to continue to lead as the electric mobility revolution accelerates,” says the company.

Helping, the Biden Administration is committed to building a national network of 500,000 EV charging stations by 2030.

Earnings have been solid, too. Third-quarter revenue, for example, was up 93% to $125.3 million YoY. Networked charging systems revenue for the third quarter was $97.6 million, up 105% from $47.5 million YoY. Also, subscription revenue was $21.7 million, up 62% from $13.4 million YoY. For Q4 2022, CHPT expects revenue to fall in the range of $160 million to $170 million, which would be 108% above year-ago numbers.

Fidelity Electric Vehicles and Future Transportation ETF (FDRV)

Another hot EV ETF to consider is the Fidelity Electric Vehicles and Future Transportation ETF (BATS:FDRV). At $14.77, with an expense ratio of 0.39%, the ETF offers exposure to companies involved in the production of electric and/or autonomous vehicles, components and technology, and other companies that are working to change the future of transportation. Some of its top holdings include Nio (NYSE:NIO), Tesla, Qualcomm (NASDAQ:QCOM), Nvidia (NASDAQ:NVDA), Intel (NASDAQ:INTC), Aptiv and Garmin (NYSE:GRMN).

On the date of publication, Ian Cooper did not have (either directly or indirectly) any positions in the securities mentioned. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.