The S&P 500 has been in bear-market territory for more than a month, but it is breaking higher this week.

We think there is reason to hope the trend will continue.

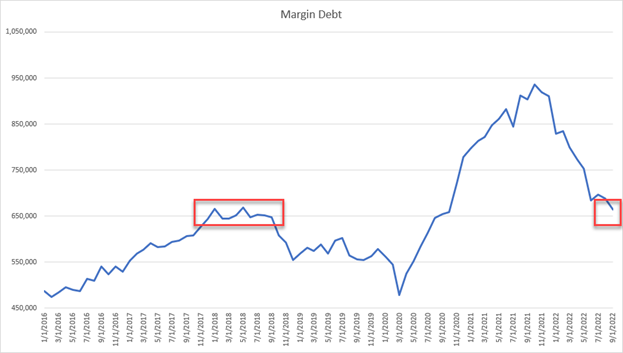

The first sign of hope is traders have reduced their leverage and margin debt has returned to a more sustainable level.

Traders (you included) can borrow up to 50% of the purchase price of a stock – according to Regulation T of the Federal Reserve Board. That means if a stock costs $100, you are only required to put up $50 of your own money to purchase the stock. You can borrow the other $50.

Traders borrow money for their trades to increase their leverage, or potential for return, in the trade. If you use 100% of your own money to buy a stock, and the stock increases in value by 10%, you make a 10% return on your money.

But if you only use 50% of your own money and then borrow the other 50% to buy a stock, you make a 20% return on your money if the stock increases in value by 10%. You essentially double your potential return when you borrow half of the purchase price.

Of course, leverage is a double-edged sword. If you use 100% of your own money to buy a stock, and the stock decreases in value by 10%, you endure a 10% loss on your money. But if you only use 50% of your own money and then borrow the other 50% to buy a stock, you suffer a 20% loss on your money if the stock decreases in value by 10%. You double your potential losses.

Confident traders tend to increase the leverage in their trades by borrowing more. They want to generate larger returns. Nervous traders tend to decrease the leverage in their trades by borrowing less. They want to protect their capital.

Borrowing money to buy stocks is referred to as buying on margin, and the amount of money you have borrowed to buy stock is called “margin debt.”

Tracking the total amount of margin debt being used on Wall Street to buy stocks can give you a good sense of how confident traders are.

Margin debt reached its highest level ever of $935.9 billion in Oct. 2021. Traders have been unwinding this leverage ever since, which has added selling pressure to the bearish downtrend the S&P 500 has been in since reaching its all-time high on January 4, 2022.

According to the latest numbers from FINRA, as of Sept, 2022, Wall Street has cut its borrowing by nearly a third to only $664 billion to buy stocks.

The second sign of hope is bond traders have allowed the 10-year Treasury Yield (TNX) to drift back down to 4% after climbing as high as 4.33% on Oct. 21.

Rising rates, like the TNX, had been exerting bearish pressure on growth stocks by forcing traders to discount the value of companies’ future earnings.

With rates coming down, traders will likely feel more comfortable paying a higher price for future earnings.

The third sign of hope is currency traders have allowed the value of the U.S. dollar (USD) to pull back and start consolidating.

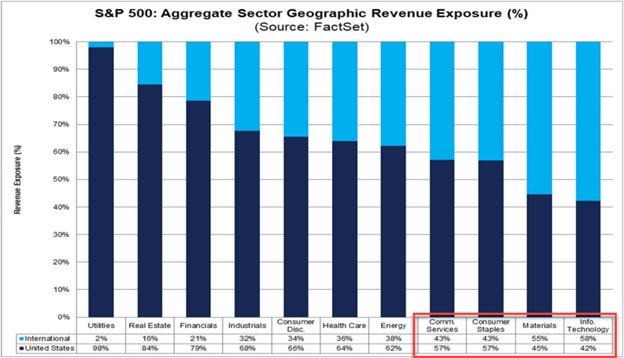

This decrease in the value of the USD should help companies that earn revenue overseas.

When the value of the USD is stronger, companies get less bang for their buck from revenues generated overseas because the conversion rate works against them when they bring the money back to the United States.

For example, if a company generates €1 million in profits in Europe when the EUR/USD exchange rate is 1.20, the company can claim $1.20 million in profits when it repatriates the money because €1 is equal to $1.20.

However, if a company generates that same €1 million in profits in Europe when the EUR/USD exchange rate is 1.05, the company can only claim $1.05 million in profits when it repatriates the money because €1 is only equal to $1.05.

As the USD gets stronger and stronger, companies that generate a larger percentage of their revenue overseas are going to feel the pinch. Conversely, companies that generate a smaller percentage of their revenue overseas are going to benefit.

Looking at the Geographic Revenue Exposure chart below, you can see that sectors like Information Technology, Materials, Consumer Staples, and Communication Services are going to benefit from a weaker USD because they have more international revenue exposure.

The Bottom Line

We still have to make it through earnings season without any major negative earnings or economic surprises. But so far, it looks like Wall Street is willing to push the S&P 500 higher in the coming weeks.

And as that happens, we want to reiterate that there’s a way to generate instant income – no matter where the market goes tomorrow, next week, or the next year.

By tapping into a powerful anomaly that exists in the markets, practically anyone can generate upwards of $350 to $520 in five minutes or less.

The best part is, you can tap into this income stream just about every day the markets are open… and can potentially use this one secret to generate over $30,000 in instant cash over the course of an entire year.

We’ve utilized this method for years in our Strategic Trader research service, and our colleague, Louis Navellier, was so compelled by our trades (with a 95%-win rate), he flew to one of the poorest zip codes in America to show a few folks off the street exactly how to do it,

Sincerely,

John and Wade