As inflation has surged to fresh 40-year highs in June, investors are worried about how runaway prices might impact their portfolios. But according to legendary investor Michael Burry, those worries may be misplaced.

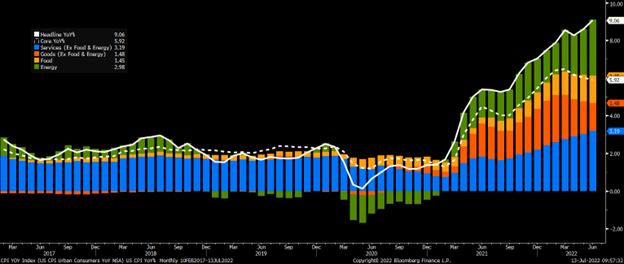

Yesterday, June’s Consumer Price Index (CPI) data was released. And the numbers were hot. Consumer prices jumped 9.1% year-over-year in June. That beat expectations for an 8.8% gain and represented the highest inflation rate in about 40 years.

In response, stocks dropped yesterday. But maybe they shouldn’t have…

A few weeks ago, Burry — famous for his correct bet against the 2008 housing market — took to Twitter. He told his 900,000 followers that inflation will soon turn into disinflation.

He’s not alone in that thinking.

In a recent CNBC interview, tech fund manager Cathie Wood said that today’s inflation sets the stage for deflation. Nobel Prize-winning economist Paul Krugman noted in a Twitter thread last week that runaway inflation expectations have “collapsed.” Wharton finance professor Jeremy Siegel has suggested that inflation pressures are waning. And last week, Tom Lee, former chief equity strategist at JPMorgan (JPM), noted that inflation threats are receding.

Across the board, the so-called “smart money” has spoken. They aren’t concerned about inflation at all. They think it will die.

Yet, yesterday, we got a fresh round of inflation data suggesting that trends are accelerating, not decelerating.

So… what are all those influential investors seeing that the rest of us aren’t? Why are they so confident that inflation is falling when the headline inflation numbers are as elevated as ever?

Let’s take a deeper look.

The Supply-Demand Picture Is Improving

In the big picture, inflation trends were elevated throughout 2021 and into 2022 because of a global supply-demand imbalance. Economic demand for goods and services outstripped their supply.

That imbalance is now swinging in the other direction, which is very bullish for stocks.

Specifically:

Economic Demand Is Waning

The global economy is slowing very quickly right now. Consumer confidence in the U.S. has plunged to record lows. Small business confidence has collapsed to its lowest levels since 2013, on track for its steepest decline since before 2008. Consumer spending is slowing. Jobless claims are rising. Across the board, the U.S. economy is rapidly decelerating. And that is translating into weaker consumer and enterprise demand for goods and services.

The Fed Is Hiking Rates

The U.S. Federal Reserve is currently embarking upon its most rapid and aggressive monetary tightening process in over 40 years. Higher rates are designed to help choke off economic demand via higher borrowing costs. Consequently, it seems likely that, thanks to these rate hikes, economic demand will continue to fall over the coming months.

Supply Chains Are Improving

Throughout 2022, global supply chains have meaningfully normalized following COVID-related disruptions. According to the New York Fed’s Global Supply Chain Pressure Index, pressures have improved by about 50% since early 2022. At this rate, supply chains should be back to “normal” by 2023.

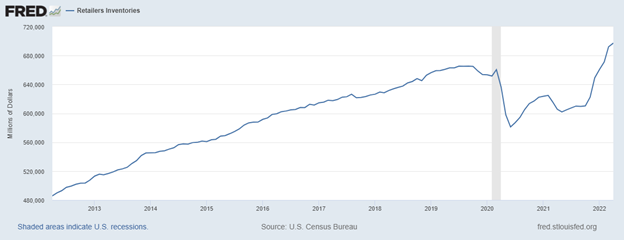

Inventory Stockpiles Are Huge

Economic demand remained high in 2021 while supply chains were still broken. So, retailers over-ordered goods to fill what were, at the time, empty inventory shelves. However, supply chains have quickly normalized. A ton of product was still shipped to those retailers as the economic demand for goods slowed. The result? A record inventory build. Retailer inventories have soared throughout 2022. And after being “below trend” throughout 2020 and 2021, retailer inventory levels are now “above trend.”

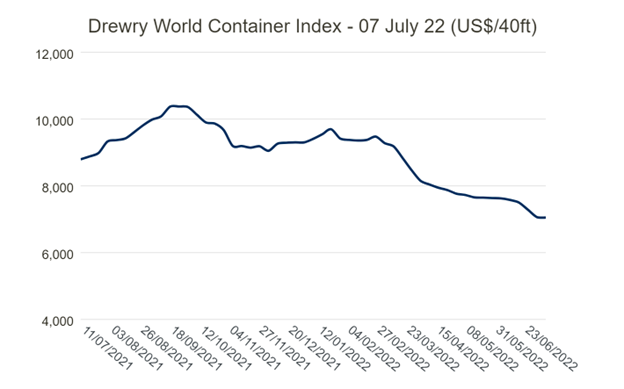

Freight Prices Are Dropping

The Drewry’s composite World Container Index tracks freight costs of 40-foot containers on major routes. And as production capacity’s increased, economic demand has waned, and inventories have grown, it’s fallen over 30% since September.

Together, the aforementioned data paints the picture of a global economic situation that’s rapidly shifting from high-demand/low-supply to low-demand/high-supply.

The former environment creates inflation. The latter produces disinflation.

That’s why billionaire investors are confident inflation will fall. And it’s also why stocks should rise in the coming months.

The Final Word on Inflation

Yesterday’s inflation print was spooky. No doubt about it. An inflation rate above 9% is not good for the economy. It’s not good for stocks. It’s not good for much of anything.

Fortunately, the supply-demand fundamentals underlying global inflation trends strongly suggest that the 9% reading won’t stick around.

Instead, they strongly suggest inflation rates will rapidly drop from 9%, to 7%, to 5%, to 3%. We think the U.S. economy will be looking at 2% inflation within 12 months.

That’s why we’re bullish on stocks right now. Inflation killed equities over the past 12 months. And disinflation will boost them over the next 12.

Is your portfolio prepared for this major rebound rally in stocks?

If not, let me tell you the best way to get there.

Prep Your Portfolio for Huge Gains

There is a tiny, $3 technology stock out there that I think may be the single most compelling 12-month investment opportunity in the market today.

The world’s largest company — Apple (AAPL) — is about to the enter the electric vehicle game. It’s been working on a super-secret “Apple Car” project since 2015. And late last year, the company reportedly increased investments in the project to accelerate its development timeline.

The implication? Apple will likely launch its own EV within the next two years.

Judging by Apple’s success with the iPhone, the iPad, the Mac, the Apple Watch, and more, it seems very possible that its car is a huge hit. It even seems possible that this car unseats Tesla (TSLA) as the best-selling EV in the market.

If so, the Apple Car could be bigger than all the company’s previous successes put together.

And per my analysis, the $3 stock I’m talking about is positioned to secure a partnership with Apple to supply a critical piece of technology to make this car work.

If that sounds like a big deal, it’s because it is. My modeling suggests this tiny stock could soar 40X over the next few years.

So… what’re you waiting for? Learn more about what may be the most exciting investment opportunity in the market today.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.