Inflation has made it much harder to buy what you want with twenty bucks — except for in the stock market, where you can find plenty of cheap stocks under $20. And right now, I’d like to talk about three specific cheap stocks under $20 that are ready to grow in your portfolio.

Now, some investors may be hesitant. After all, Wall Street is in the midst of a bear market and stocks overall just finished their worst first half since 1970!

To say the least, there are plenty of stocks taking it on the chin due to inflation, rising interest rates, ongoing supply chain issues, labor market and at-risk consumers. But guess what? The market is also a forward-looking pricing mechanism.

Today and with a recession looking priced in, it’s time to consider three attractively cheap stocks under $20 to buy now.

| F | Ford Motor Co. | $11.27 |

| STNE | StoneCo Ltd. | $8.19 |

| PATH | UiPath | $18.32 |

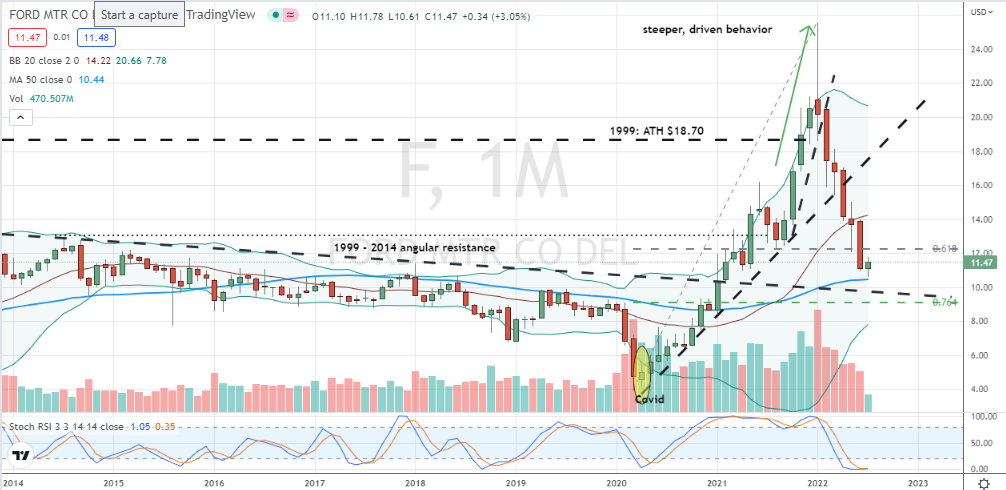

Ford (F)

Source: Charts by TradingView

Ford Motor Co (NYSE:F) is the first of our cheap stocks under $20.

Ford stock, of course, needs no introduction. The automaker’s vehicles have been around since the very beginning and its longstanding F-series trucks continue to be the most popular worldwide.

What makes this cheap stock under $20 exceptionally attractive is it’s dirt cheap and has solid blue-chip financials to weather a recession. there’s also a well-supported 3.5% dividend for Ford shareholders.

That’s not all. Ford is making a smartly-throttled transition into the electric vehicle market with the Mustang Mach-E and E-Transit and most recently it’s sold-out all-electric F-150 Lightning pickup truck. Given an EV market which Ford sees as making up to 50% of global sales by 2030, this cheap stock under $20 is firing on all cylinders.

Throw in a deeper six-plus-month pullback that’s retraced roughly 70% of F stock’s Covid rally and appears to be bottoming in a monthly hammer pattern just above prior multi-decade resistance, and it’s time for investors to park some cash in shares!

StoneCo Ltd (STNE)

Source: Charts by TradingView

StoneCo Ltd (NASDAQ:STNE) is the next of our cheap stocks under $20 to purchase.

Most of us can only drool over getting in on an initial public offering, or IPO, like Warren Buffett’s Berkshire Hathaway (NYSE:BRK-A, NYSE:BRK-B). But today, fearful selling over the past sixteen or so months is allowing regular investors the chance to join and beat the Oracle of Omaha at his own game — value investing.

Brazilian fintech StoneCo Ltd is a Berkshire holding back from 2018, when STNE stock debuted on the NYSE for $24 and the investment manager picked up 10.7 million shares. Today, almost four years since going public, this stock is priced at just $8.19 per share.

Challenges responsible for STNE’s decline include company missteps such as a shaky loan portfolio which dinged cash flow in 2021, a write-off of $230 million investment in Banco Inter, weaker currency translation and broader macro-related headwinds facing growth and more recently, even value stocks.

But as The Motley Fool notes, solid triple-digit growth in StoneCo’s transaction volumes and customer counts, greatly improving adjusted net profit margin, as well as ballooning and record-breaking Q1 revenue gains of 139% are factors that make a strong case for ownership.

Add in a confirmed monthly hammer bottom, and this cheap stock under $20 looks like a strong buy for value, growth and technical investors alike.

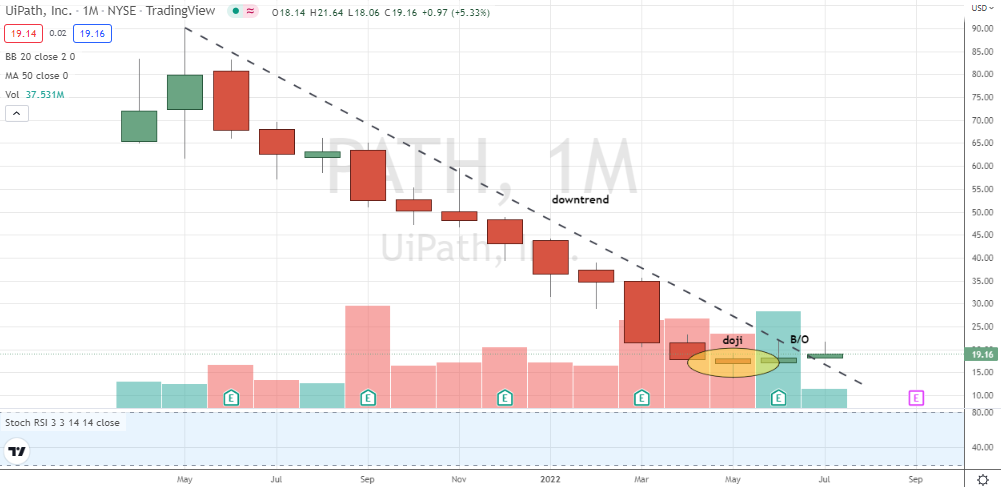

UiPath (PATH)

Source: Charts by TradingView

UiPath (NYSE:PATH) is the last of our cheap stocks under $20 for investors to buy today.

Fund manager Ark Invest, led by Cathie Wood, made a notorious and enviable name for itself with its actively managed, high-octane growth portfolios in the wake of the 2020’s history-making bear market. And then, it kept making headlines for all the wrong reasons over the past sixteen months as those same Ark Invest funds cratered back towards their pandemic bottoms.

But while the shift from first-to-worst for its funds has bolstered Wood’s “meme market queen” status, it’s notable the investment firm has continued to accumulate robotics process automation (RPA) play PATH stock over the past year.

Ark’s own accumulation efforts have led to a cost basis is in the low $60s in this cheap stock under $20. That means PATH would need to rally by more than 200% and retrace roughly 62% of the stock’s lifetime downtrend just in order for the fund to just break even.

An upside move of that magnitude in today’s bearish market, let alone Ark eventually profiting on PATH, might seem like a stretch. Importantly though, the firm’s commitment has resulted in UiPath becoming the fund’s fifth-largest holding.

Controlling more than 8% of UiPath’s shares, it’s one of the most heavily vested by Ark Invest.

The good news is investors don’t have to be like Cathie to enjoy big-time profits much sooner in this cash flush, growth stock. Technically, this past year’s bear market may have already bottomed with a confirmed monthly doji in June.

Now and with shares just clearing PATH stock’s lifetime downtrend line in July, the path for this cheap stock under $20 to move toward its highs looks clearer.

On the date of publication, Chris Tyler holds, directly or indirectly, long stock in Ark Genomic Revolution ETF (ARKG) but no other securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.