Editor’s note: “Capitalize on the Emerging Age of AI for Hefty Profits” was previously published in March 2023. It has since been updated to include the most relevant information available.

Crisis creates opportunity. And big crises create big opportunities.

For example, did you know that the Internet Economy – which created the world’s first trillion-dollar companies, churning out multiple 1,000% stock market winners – was born amid the 2008 financial crisis?

Technically, the internet was born in the 1990s – the World Wide Web launched on Aug. 6, 1991.

But it wasn’t until Apple (AAPL) released the first iPhone in 2007 – and put the power of the internet literally in the palms of everyone’s hands – that the Internet Economy really started to blossom.

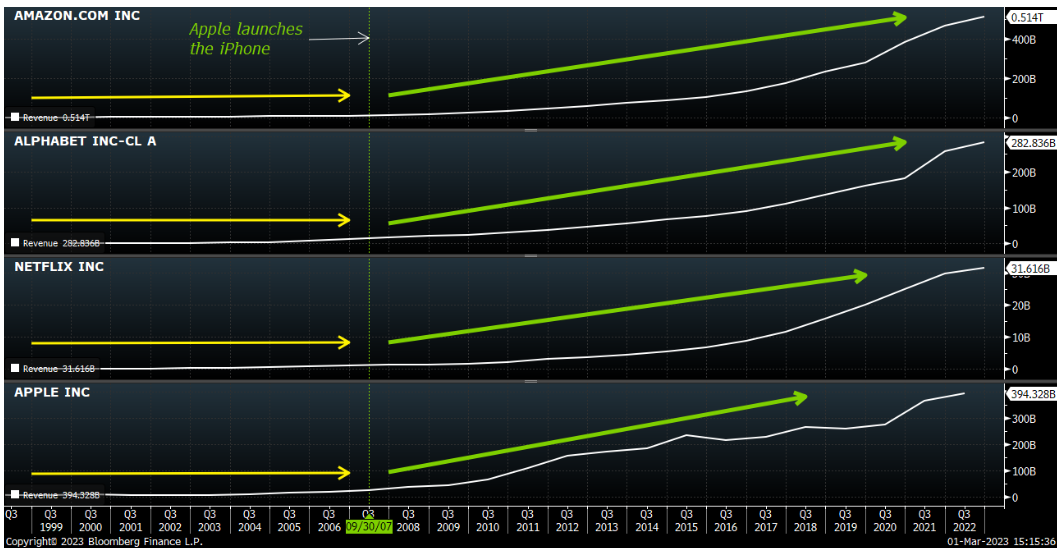

Just look at how the revenue growth trajectories for internet titans like Amazon (AMZN), Alphabet (GOOGL), and Netflix (NFLX) dramatically changed after the iPhone’s launch.

Before the iPhone, internet companies were growing. After, they started to spread like wildfire and take over the world.

It was a critical inflection point – the “tipping point” for the internet revolution…

The moment when everything changed.

Of course, at the time, it didn’t feel like that.

The financial economy was collapsing because of the subprime loan meltdown. Unemployment rates were soaring. Stocks were crashing. Companies were going bankrupt. Home foreclosures were happening left and right.

It felt like the end times, even for internet stocks like Amazon, Netflix, Alphabet, and the iPhone’s maker, Apple. All those stocks dropped between 50% and 60% in 2008 – the year after the iPhone launched.

What a crisis…

Crisis Begets Opportunity

For investors who were able to zoom out and look at the big picture, the financial crisis created the opportunity of a lifetime.

It left internet stocks trading at dirt-cheap valuations just months after the emergence of the Internet Economy’s biggest catalyst of all time – the iPhone.

Those “big-picture” investors were able to recognize that the economy wasn’t going to collapse and that the 2008 crisis – like all financial crises before it – would pass.

They were able to identify the iPhone’s significance as a critical inflection point for the Internet Economy that would spark 10-plus years of super-charged growth.

They were able to see the deep value in internet stocks. And they were smart enough to buy the dip in names like Amazon, Netflix, Apple, and Alphabet.

As a result, those “big-picture” investors have since made fortunes.

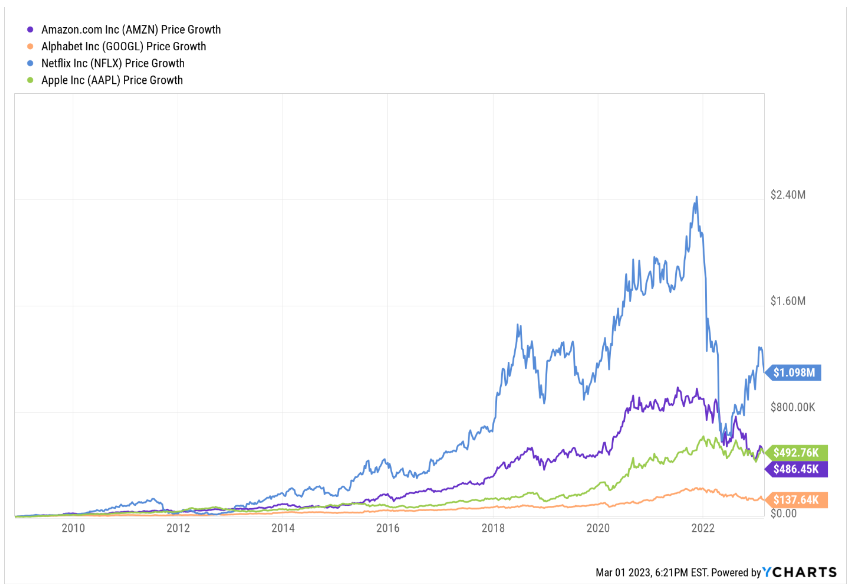

Every $10,000 invested in Alphabet stock in late 2008 would be worth nearly $140,000 today. A $10,000 investment in Amazon or Apple stock in late 2008 would be worth nearly $500,000 today. And a $10,000 investment in Netflix stock in late 2008 would be worth over $1 million today.

Said differently…

Investors who were able to zoom out and see the big picture in 2008 – and were able to realize the impact the iPhone would have on the internet economy – would’ve had the chance to turn $10,000 into a million bucks.

Opportunities like that only come around so often. When they do, you have to capitalize on them.

Well, as luck would have it, one of those opportunities is emerging right now.

AI’s “iPhone Moment”

The burgeoning field of artificial intelligence (AI) just had its iPhone moment last year, when Microsoft-backed OpenAI launched ChatGPT. This put the power of sophisticated AI in the hands of everyone with a computer.

Like the internet in the 2010s, AI promises to change every facet of our global economy in the 2020s. It will represent a massive paradigm shift in the way society operates and the way money flows in our economy.

It will change everything about everything. It will create a $15 trillion market by 2030.

And that revolution just had its iPhone moment.

Of course, it may not feel that way today. Stocks got crushed in 2022 and are still trying to claw their way back here in 2023. Indeed, it’s been a brutal 12 months for investors.

But this is exactly where we were 15 years ago – right after the iPhone’s launch and in the midst of a massive stock market crash.

What’s that thing they say about history? That it likes to repeat itself?

History is repeating right now before our very eyes.

The Final Word on AI

Fifteen years ago, internet stocks were crashing just months after their “iPhone moment,” thanks to an economic crisis.

Today, AI stocks are crashing just months after their own “iPhone moment” because the economy is enduring a crisis.

Back then, “big-picture” investors who were able to zoom out and recognize the importance of the internet and the iPhone – and buy the dip in internet stocks – have since made fortunes.

Today, “big-picture” investors who can recognize the importance of AI – and buy the dip in AI stocks – will give themselves the chance to make fortunes, too.

The choice, of course, is yours.

Let the opportunity of a lifetime pass you by – or capitalize on it now.

If you want to take advantage of this revolutionary moment, then I highly suggest you check out our first-ever AI Super Summit. It’s an event we held specifically to help investors capitalize on what may be the biggest technological paradigm shift of our lifetimes.

We even disclosed a few of our top AI stocks to buy right now.

Check out a replay of that event now.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.