Editor’s note: “The Breakout Stocks of an Industry Set to Grow 40X” was previously published in December 2022. It has since been updated to include the most relevant information available.

There are a lot of exciting technological innovations and trends out there these days. Right now, AI is getting all the hype.

And while I’m extremely bullish on AI’s economic potential and believe the best AI stocks in the market will soar over the next few years… I actually think a different tech trend will have a much bigger impact on society in 2023.

I also think the stocks in this trend will soar much more than AI stocks this year.

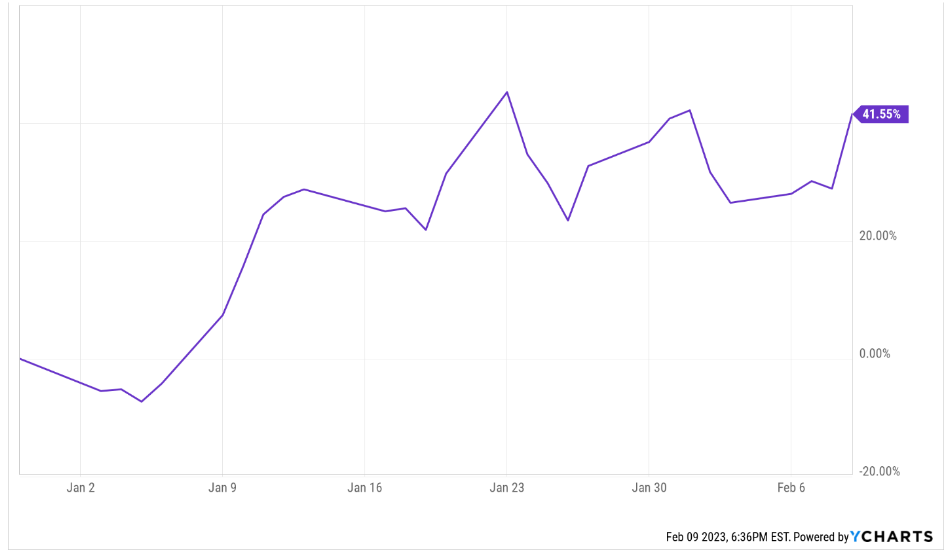

But don’t just take my word for it. The market seems to agree. My top stock pick in this particular tech trend is already up more than 40% in 2023!

And I think the rally for this tech stock is just getting started.

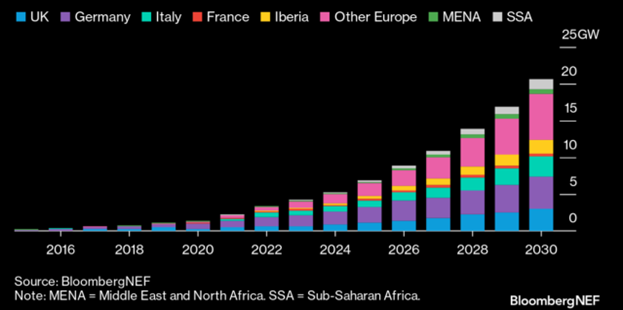

That’s because, according to Bloomberg’s research team, the technology we’re talking about here will see its European adoption grow by nearly 40X between now and 2030.

And Bloomberg isn’t alone.

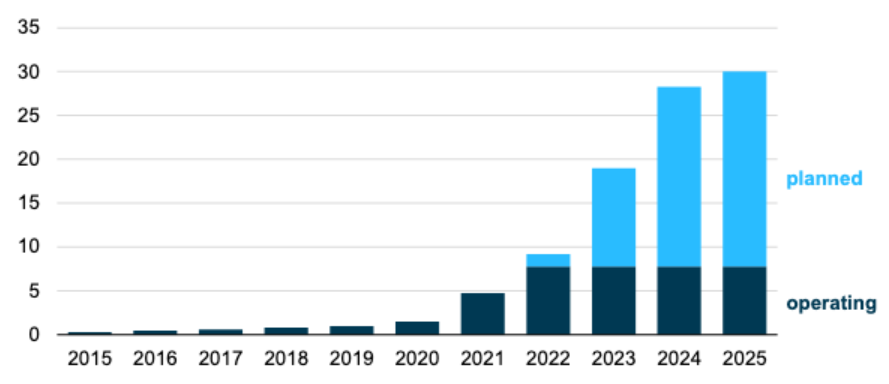

Researchers at the Energy Information Administration (EIA) recently said this industry will grow by 20X in the U.S. by 2025 alone. The EIA also said that 2023 will be a record-shattering year for this new tech.

What am I talking about here? Energy storage technology. And I think energy storage stocks represent more than just one of the best investment opportunities of 2023. They offer some of the best investment opportunities of the decade, too.

Say Hello to the New Energy Economy

Before we talk about energy storage stocks – and why they represent the best investment opportunity on Wall Street right now – let’s first talk about the broader movement that energy storage stocks are a part of: the New Energy Economy.

In short, the world doesn’t have enough energy. We have too little energy production and far too many people. We need more. Some folks think that means more coal power plants. Some think it means putting solar panels and wind turbines everywhere. Others think it means restarting nuclear plants or introducing hydrogen as an energy source.

In reality, the New Energy Economy is about doing all of that together. We need a little more of everything. But given newly introduced legislation, the U.S. and other major governments have made it abundantly clear that they intend to build the New Energy Economy on the back of clean energy.

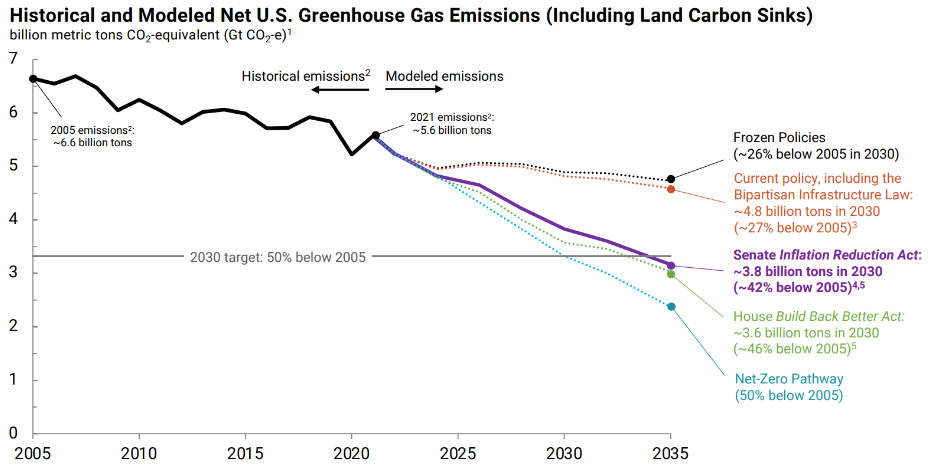

Just months ago, the U.S. Senate passed the world’s largest climate bill, allocating almost $400 billion to the country’s energy sector.

Some of the spending is going toward the oil and natural gas industry. However, the bulk is being pumped into incentivizing the production of alternative energy sources.

Inside the Legislation

There are a lot of moving parts. But at a high level, this legislation will:

- Extend 30% investment tax credits (ITCs) for solar another 10 years into 2033.

- Introduce a new 20% ITC for standalone energy storage.

- Create additional potential ITCs of up to 20% for clean energy projects that meet certain labor and location requirements.

- Introduce a new 10-year production tax credit (PTC) for green and blue hydrogen.

- Extend the EV tax credit indefinitely, remove the credit cap on manufacturers that have sold more than 200,000 EVs, and allow that tax credit to be applied at the point-of-sale.

- Introduce a new EV tax credit for used EV sales.

That’s a lot. It is one of the most important pieces of legislation in U.S. history.

Specifically, it is the largest-ever climate bill to be passed by the U.S. Senate at a time when the incentive, urgency, and need to reinvent America’s energy system has never been greater. (Between soaring gas prices, rolling blackouts, and sky-high electricity bills, none of us are happy)

Consequently, many analysts project that, thanks to this legislation, the Clean Energy Revolution will experience an unprecedented boom in the 2020s.

We agree. This legislation sets the stage for rapid and robust uptake of hydrogen, electric vehicles, solar, and ESS technologies over the next decade.

Most of the media attention over the past few months has been focused on the EV tax credit. But we actually think another tax credit in the bill is far more important.

And it represents a far bigger investment opportunity.

The Best Clean Energy Sector to Invest in Today

On the heels of this new legislation, investors have a multitude of options to choose from when it comes to investing in the accelerated Clean Energy Revolution.

You have solar stocks, which we like. Indeed, solar is the cheapest clean energy source in the world and has robust power potential. Plus, the recent bill just extended massive ITCs for solar by a decade.

You have wind stocks, which we also like. Wind farms can generate power on a massive scale, and wind turbines can be built offshore.

And you have hydrogen stocks, which we really like. Hydrogen – unlike solar and wind – is transportable and ultra-dense. Not to mention, the new climate bill creates the first-ever PTC for clean hydrogen.

But our favorite niche of the Clean Energy Revolution, which we believe will yield the biggest stock market winners, is the energy storage sector.

Energy Storage Holds the Key

The story here is shockingly simple.

Of all the knocks against clean energy, only one really has any merit. And that’s the intermittency issue.

That is, solar and wind are intermittent energy sources. The sun doesn’t shine every day. And the wind doesn’t always blow. By themselves, clean energy sources cannot power the world at all times. It’s scientifically impossible. They need help.

Energy storage is that help.

Those technologies allow humans to store excess solar and wind energy in things like batteries. Then the energy can be deployed when the sun isn’t shining, or the wind isn’t blowing. It enables continuous power output at all times.

Energy storage technologies solve the huge intermittency problem of clean energy sources, and ultimately make them as reliable and consistent as fossil fuels.

So, let me state this clearly…

Clean energy can power the world – but only with the enormous help of energy storage solutions.

Therefore, if the New Energy Economy will be defined by tons of clean energy (which the recent climate bill ensures that it will), then the New Energy Economy will also be defined by tons of energy storage capacity.

We’re talking small-scale energy storage batteries at every house with solar panels… mid-scale energy storage technologies at every office and commercial building powered by clean energy… and large-scale energy storage systems at every solar and wind farm.

We’re talking energy storage solutions everywhere there is power – so, quite literally, everywhere.

That may sound outlandish today. But think about it – there are already dozens of batteries in your home. There’s one in your iPhone and in your computer. There’s one in your electric car. What’s another one in your garage to power your home?

It’s nothing – and that’s why energy storage technologies will become globally ubiquitous.

Energy Storage: The Fastest Growing Industry in the 2020s

On its march toward global ubiquity, the energy storage industry will turn into the fastest growing industry in the 2020s.

Let me repeat that. If energy storage technologies do become globally ubiquitous, the energy storage market will emerge as the fastest growing industry in the world throughout the next decade.

Potentially even bigger than AI…

Here are the numbers.

At the end of 2021, global installed energy storage capacity measured about 46 GWh. According to our analysis, that means less than 1.5% of renewable energy production in the world is backed by energy storage today.

We think that by 2030, that number grows to 800 GWh of energy storage capacity. We’re not alone in that thinking. Bloomberg New Energy Finance is targeting at least 800 GWh of global energy storage capacity by 2030. So is every other major clean energy market research firm.

That means this market is going to grow from 46 GWh of capacity in 2021 to 800 GWh of capacity in 2030. That’s a 17X gain in 9 years. In certain geographies – like Europe, where the energy crisis is more severe – Bloomberg expects the industry to grow by 40X!

To our knowledge, no other industry is due for so much growth over the next decade.

And believe it or not, that’s just the tip of the iceberg…

Major Growth Ahead

At 800 GWh of installed capacity in 2030, only about 10% of the renewable energy capacity in the world will be backed up by energy storage technologies. That’s not enough for a net-zero society. We need a number closer to and above 30%.

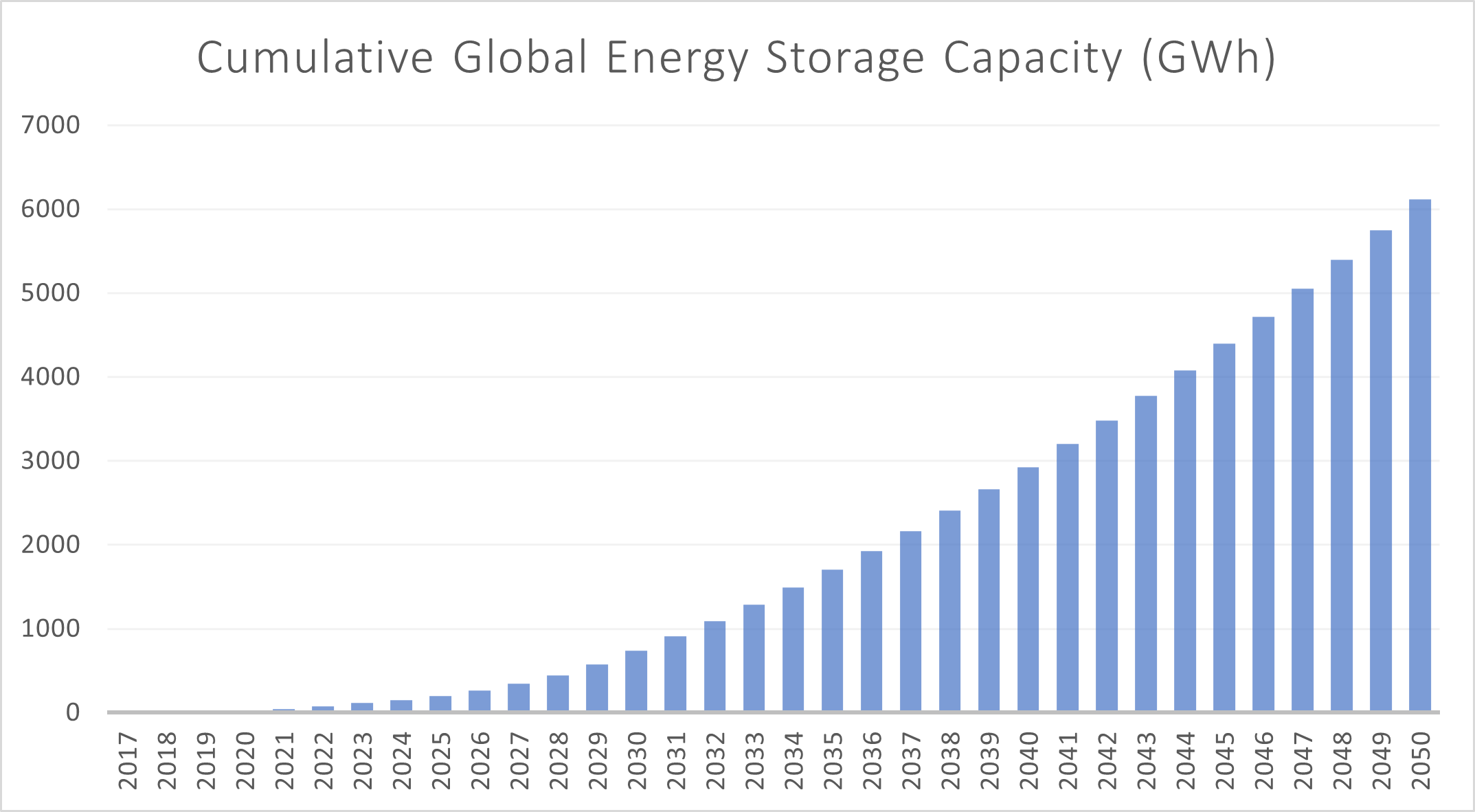

That’s exactly where we believe our society is headed. We think that by 2050, global installed energy storage capacity will back up around 30% of global renewable energy capacity. And that will equate to around 6,000 GWh of energy storage capacity.

That’s more than 75X growth from 2020 levels.

That bears repeating: 75X growth into 2050.

Again, to our knowledge, no other industry in the world is positioned to grow this much, this quickly.

And all that growth starts now. The U.S. government formally introduced the first-ever tax credit for standalone energy storage projects. Since then, we have observed a flurry of positive business developments in the energy storage sector. Those have led to energy storage firms reporting excellent quarterly numbers, and many of their stocks have been soaring.

For example, this past week, our favorite energy storage firm – the one highlighted in the chart earlier – reported outstanding quarterly numbers and materially hiked its full-year revenue guide, citing accelerating demand for the company’s energy storage products. The stock popped in response.

The catalyst for 75X growth has arrived, and it’s already yielding real-world benefits. The market’s best ESS stocks are already off to the races on Wall Street!

The Final Word on Energy Storage Stocks

We are hyper-bullish on energy storage stocks for the 2020s. We think that this will be the fastest-growing industry in the 2020s and that all that growth will start today with the introduction of first-of-its-kind legislation to spur energy storage projects.

Energy storage represents the next great investment opportunity.

Like PCs in the ‘80s…

The internet in the ‘90s…

Cloud computing in the 2010s…

In the 2020s, energy storage will change the world as we know it. It’ll grow by thousands of percent and mint a new generation of millionaires. As it turns out, those millionaires will likely just be regular folks who believed in a big idea before the rest of the world caught on…

The question is: Will you be one of them?

If you want to be, I highly recommend you click here to learn about the next generation of superstar stocks.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.