In May 2022, Lyft (NASDAQ:LYFT) plunged from $30 to the low $20s. It fell again during the technology wreck sell-off this month. Investors abandoned LYFT stock when Uber’s (NYSE:UBER) Chief Executive Officer said it would cut costs and limit staff hiring.

Lyft and Uber are among the 2021 winners when countries lifted the pandemic lockdown. Since then, the market suffered a seismic shift that ride-sharing firms cannot ignore. Instead of riding it out (pardon the pun), investors are selling the stock.

Lyft already lost 65% of its value from its 52-week high. Selling now only realizes a capital loss. Investors who sold may regret it.

Lyft Stock Falls After Competitor Remarks

On May 9, 2022, Uber said it would cut spending, incentives, and marketing. It would also treat hiring as a privilege. In the first quarter, Lyft’s competitor posted a net loss of $5.9 billion. $5.6 billion in headwinds is due to Uber’s equity investments. Uber revalued Uber Grab, Aurora, and Didi holdings. It also booked a net loss of $359 million in stock-based compensation.

Uber is among many technology firms whose stock-based compensation destroyed shareholder value. The decline in stock market valuations will hurt Uber and Lyft’s money-raising efforts. The firms must cut expenses and freeze hiring. It needs to anticipate the economic slowdown in the next six months.

Uber previously targeted an adjusted $5 billion in EBITDA profitability by 2024. The economic headwind changes Uber’s forecast.

Bright Spots From Lyft’s First Quarter

In the first quarter, Lyft posted revenue growing by 44% YOY to $876 million. Its revenue per active rider of $49.18 is the second-highest on record. Active riders increased by 32% YOY to 17.8 million. On a Q1 adjusted basis, Lyft posted $55 million in EBITDA. This is above the high end of its outlook, exceeding its target by around $40 million.

Lyft has a healthy balance sheet. I ended the quarter with $787.4 million in long-term debt.

Despite the strong results, markets are pricing the impact of higher gas prices in the current quarter. For example, Lyft increased its driver count by 40% YOY. Investors worry about the impact of soaring gas prices on Lyft’s drivers.

Gas Prices Hurt Lyft Stock

Lyft enjoyed favorable year-on-year comparisons. Last year, Covid-19 cases at the height of the pandemic hurt Lyft driver growth. Last quarter, driver earnings rose. They earned around $24 on average. This is before Lyft added a 55-cent gas surcharge.

Lyft is preparing for the risk of high gas prices hurting its business. It is seeking a positive return on investment opportunities. It will accelerate its investments in projects that result in better service levels. Investors who abandoned Lyft stock will not realize the positive upside from that business objective.

Lyft did not specify what initiatives would raise its ROI on its conference call. Shareholders will only notice a projected increase in research and development, sales and marketing, and general and administrative cost increases. Those investments will pay off for long-term Lyft shareholders.

Lyft is a Speculative Buy From Here

Few investors recognize the importance of Lyft in supplying ride-sharing services. Instead, they are panic selling the stock on worries revenue and margins from the sharing model will fall. The company’s Q1 results suggest this negative assumption is wrong.

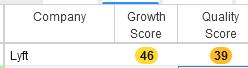

Lyft’s stock score is good, contrary to the market’s negative opinion.

Chart courtesy of Stock Rover

Lyft has fair quality and growth scores, according to Stock Rover. Assume that the business momentum in the current quarter will continue from the last quarter. This will send Lyft’s quant scores and its share price higher.

On the date of publication, Chris Lau did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.